On average, it takes two to five business days for a check to clear. Business days are generally considered any weekday, Monday through Friday, that isn’t a bank holiday. For most checks, it’s typical for banks to make the first $200 available the business day after they receive it, with the remaining amount issued the following business day.

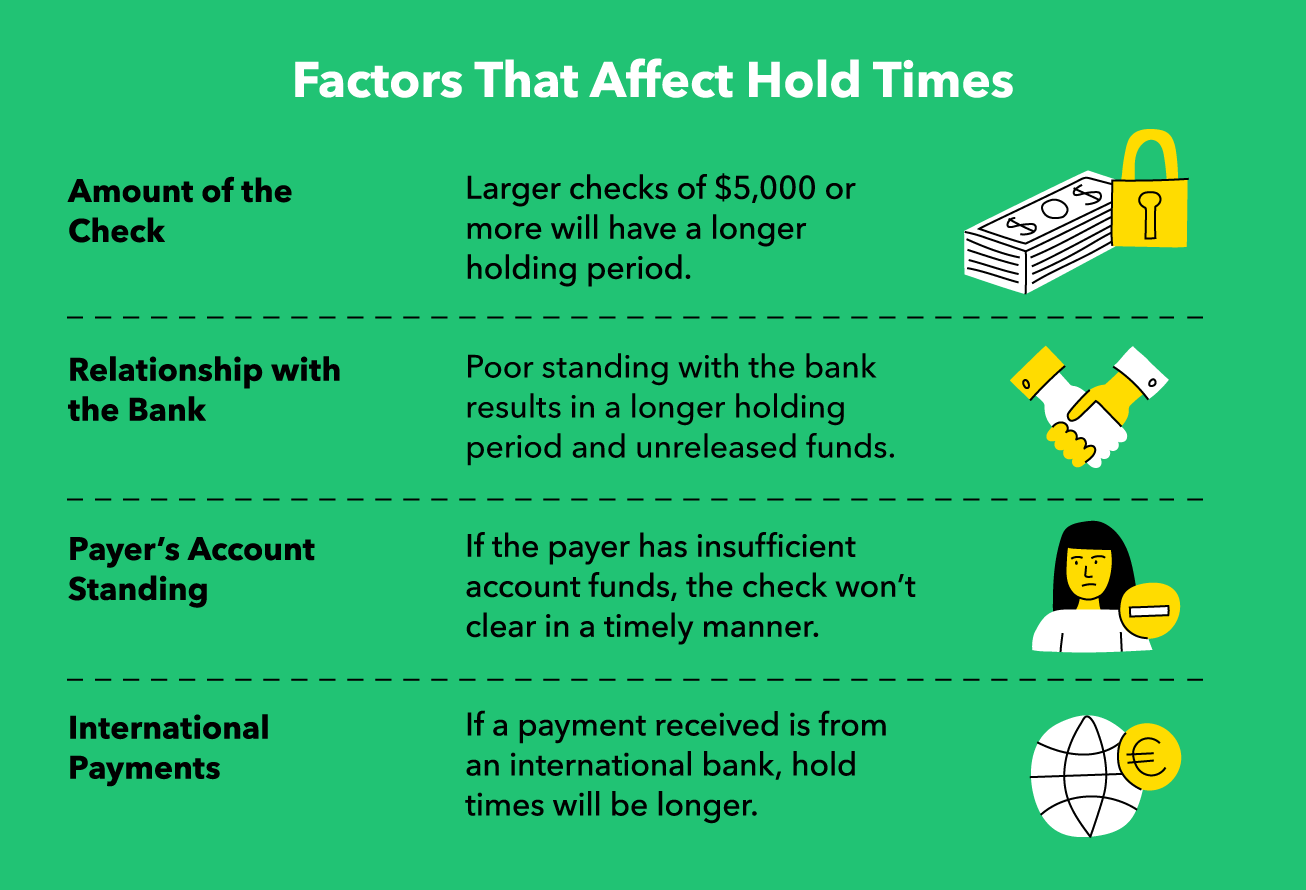

Other factors that can affect when checks are released can include the amount in the payer’s checking account, the recipient’s relationship with the bank, and the amount of money the check is issued for. Large personal checks may have longer holding periods. Government checks and other certified funds have first business day after deposit availability by law.

How Long Does It Take for a Check to Go Through?

On average, a check will clear in two business days. Some banks, however, can clear them faster.

Certain circumstances can cause a delay in the processing of up to seven business days. These cases are often due to insufficient funds, a large amount of money being deposited, an account newer than 30 days, or repeated overdrafts in the payer or recipient’s account. When a check falls under one of these conditions, the bank considers the check “risky.”

When processing a check, the bank collects the funds from the payer’s account. Occasionally, a bank may deposit the check’s amount into the receiver’s account prior to collecting the funds, as long as the check is not deemed “risky.” This means the funds are available to withdraw immediately. However, if this occurs and the check subsequently bounces, the funds are unavailable from the payer. In cases such as these, the bank could remove the deposited amount from your account.

How to Know If Your Check Cleared

The best way to ensure that a deposited check has cleared is by calling the financial institution the check was deposited to.

There is federal regulation in place that requires United States banks to notify the recipient of a check greater than $2,500 if it bounces. The law does not apply to checks issued for smaller amounts. Unfortunately, fraud protection does not cover bad checks, and you as the account holder will be responsible for the repayment of the reversal, even if the amount has been spent.

How a Check Clearance Works

The clearing cycle of a check refers to funds moving from the payer’s account to the recipient’s. Typically, unless the bank has reason to believe the check won’t clear, banks can move the money into the recipient’s account before collecting the check amount from the payer’s bank. When a check is deposited, the recipient’s bank requests the funds from the payer’s bank. When payment cannot be honored because of insufficient funds, the bank could need to process a return.

Typically, it may take about two days after the payment is processed to see the withdrawal of funds, so ensure you have sufficient capital before writing a check. So how long does it take for a check to clear? In circumstances where banks don’t have reason to believe the check won’t clear, it generally takes two business days.

How Long Can a Bank Hold a Check?

A bank’s holding time of a check will vary. Factors that can affect the holding time include the amount of the check written, a recipient’s relationship with the bank, the payer’s account standing, and international transfers of funds. If the payer uses the same bank as the payee, the hold time could be shorter. Refer to your bank’s policies to find the specific hold time.

Can a Cleared Check Be Reversed?

If a check deposited clears, it technically cannot be reversed. Once the recipient cashes the check, there is little a payer can do to reverse the funds being transferred. There are infrequent exceptions in extraordinary circumstances. For example, if the payer can prove identity theft or fraud, the amount may be refunded.

How Long Does It Take for a Check to Bounce Back?

The size and technology abilities of the payer and recipient’s bank may affect the time it takes for a faulty check to bounce. For amounts over $2,500 that have bounced, the bank is legally obligated to notify you of the inability for the check to clear, according to the Federal Reserve. For smaller amounts, waiting 30 days after the funds have hit is an appropriate amount of time to assume a check has cleared and spend the money. If unsure, call the recipient’s bank to ensure the funds have cleared.

Clearance Times for Large Checks

Large checks with an amount greater than $5,000 may take longer to clear if the receiver’s bank needs to confirm the legitimacy of the check. Confirming the legitimacy prevents banks from losing money on these types of transfers. The process to confirm these amounts can take up to nine business days. In some cases, however, you will need to notify the bank before cashing a large amount. Typically, the first $200 will become available the next business day after a check is deposited.

Personal Checks

Both certified checks and cashier’s checks can be considered personal checks. Certified checks are those that are drawn directly out of a checking account. These types of checks guarantee the funds are available in a payer’s account, and are typically required if making a large purchase. Alternatively, a cashier’s check is drawn directly from the bank’s account. Two to five days is typical for the funds to clear with personal checks.

Government Issued Checks

Government and United States Treasury checks must be cleared the next business day, as long as the deposit is made prior to the bank’s cutoff time. These quick turnaround times can be attributed to the full faith and credit of the government for treasury checks.

In most cases, you can expect funds from a check to be available within two business days. Circumstances such as international transfers, available funds, poor standing with the bank, and the amount of funds being transferred can affect the clearance time. In most cases, it’s safe to assume that a check has cleared 30 days after the amount becomes available in the account.

Sources: HelpWithMyBank.gov | Sapling | LII